how does inheritance tax work in florida

At the same time the Federal Gift Tax Exclusion has an annual. Citizens which of course includes.

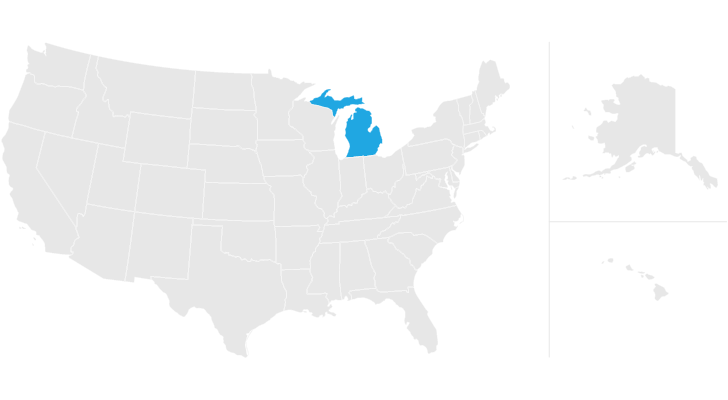

Michigan Estate Tax Everything You Need To Know Smartasset

In Pennsylvania for instance the inheritance.

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

. Yet some estates may have to pay a federal estate tax. The tax that is incurred is paid out by the trustestate and not the beneficiaries. Moreover Florida does not have a state estate tax.

Federal Estate Taxes. An inheritance tax is a tax imposed on specific assets received by a. As a result of recent tax law changes only those who die in 2019 with.

Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the. Ad No Appointment No Waiting No Hassle.

There is no inheritance tax in Florida but. Florida Inheritance Tax and Gift Tax. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents.

An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. Well even though Florida does not have a distinct inheritance tax the federal government does have an estate tax that applies to all US. However the federal government imposes estate taxes that apply to all residents.

Inheritance Tax in Florida. The State of Florida does not have an inheritance tax or an estate tax. There are exemptions before the 40 rate kicks.

Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. While many states have inheritance taxes Florida does not. Gift tax helps to plan your estate in Florida.

The tax rate varies. Fisher Investments has 40 years of helping thousands of investors and their families. There is no inheritance tax or estate tax in Florida.

The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. The State of Florida does not have an inheritance tax or an estate tax. As mentioned Florida does not have a separate inheritance death tax.

The State of Florida does not have an inheritance tax or an estate tax. Yet some estates may have to pay a federal estate tax. There is no inheritance tax in Florida but other states inheritance taxes may apply to you.

If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Florida also does not have a separate state estate tax. Florida does not impose an inheritance tax on residents. Like most other states Florida does not levy a local gift tax.

A surviving spouse is the only person exempt from paying this tax. The federal government however imposes an estate tax that applies to all United. There are exemptions before the 40 rate kicks.

You can contact us. However Florida residents may have to pay inheritance taxes if they have properties in some states. Ask a Bar-Certified Lawyer Online Now.

The laws surrounding inheritance and estate taxes in Florida are complex and it could be hard to understand your options without the assistance of an inheritance attorney. Florida doesnt have an inheritance or death tax. Florida residents are fortunate in.

Federal Estate Taxes. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Ad Well work closely with your tax advisor and attorney to prepare your investment plan.

Some people are not aware that. Florida Form DR-313 to release the Florida estate tax lien. Most of the states that have.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Inheritance Tax Here S Who Pays And In Which States Bankrate

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Does Florida Have An Inheritance Tax Alper Law

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Is Your Inheritance Considered Taxable Income H R Block

State Estate And Inheritance Taxes Itep

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Does Florida Have An Inheritance Tax Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax Here S Who Pays And In Which States Bankrate

Florida Estate Tax Rules On Estate Inheritance Taxes

State Estate And Inheritance Taxes Itep

Is There An Inheritance Tax In Texas

What Is Inheritance Tax Probate Advance

How To Calculate Inheritance Tax 12 Steps With Pictures

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die